(Foreign Coins have been found in the pre-historic graves in the Nilgiris. Sullivan while building his Fairlawns (now Smyrna Home) found Roman coins underneath. Badagas have been using gold and other coins from time immemorial for ritual purposes. Recently a German scholar has documented the rituals under the interest title, ‘Rupees in the Dollar Zone’. They were also using coins to pay the land tax which was earlier paid in poppy seeds. Badagas began using money as a medium of transaction only in the last century. However, formal banking started only after the British came.)

The first ever bank in India was started in Madras in 1683. In 1805, Governor Sir William Bentinck set up the first government bank called the Madras Bank, which was also called Government Bank. This bank served the new settlement in the Nilgiris in the initial years.

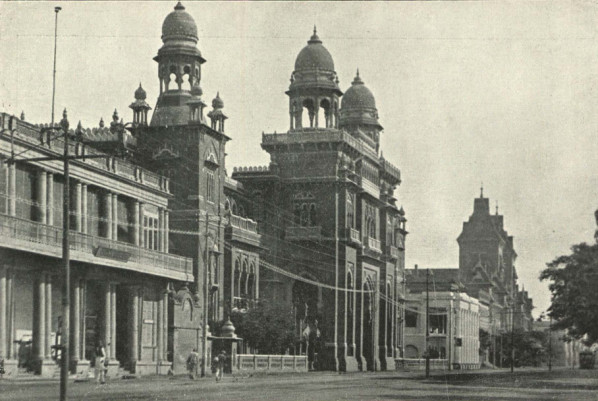

In 1843, The Bank of Madras was formed as a joint stock company with the amalgamation of Madras Bank, Carnatic Bank, the British Bank of Madras and the Asiatic Bank. Bank of Madras had a branch network spread into all the major cities and trade centers of south India including Nilgiris.

Thus, the first bank established at Ootacamund was the branch of the Bank of Madras, which was opened, on the 16th September 1866, at Hiram in the West, (near the Hill Bunk). Mr. R. Darling being the first Agent. From there it moved, on the 1st July 1868, to Bombay Castle (now Mount Stuart Hill); then, on the 1st October 1876, to Montauban on Etienne’s road.; and lastly, on the 1st April 1884, to the building, near the Library, now occupied by it.

Prior to the establishment of the branch, cheques were cashed by native tradesmen at discounts. A planters agency, Messrs. Virtue and Minchin, also used to cash approved cheques. Messers Oakes and Co and Spencers and Co and Bayly and Brock (where my grandfather was the Head Clerk) were also in the trade of discounting cheques.

By the end of the 19th century other banks such as the Agra Bank and the Oriental Bank Corporation were also actively lending and foreclosing loans in the district.

In 1921, the three presidency banks including the Bank of Madras were amalgamated into the Imperial Bank of India as suggested by the famous economist John Maynard Keynes. In 1955, after independence it became the State Bank of India.

Many SBI stalwarts were associated with the Nilgiris. Nayampally Ramananda Rao joined the bank as a clerk in 1937 and rose to become its Managing Director. He worked as an Accountant in the Ooty branch in 1945.

Late Vajifdhar, a leading citizen of Ooty, was the last of Treasurers of the Bank.

Shri. Vijayaraghavan, who had a house in Kotagiri for long, was the last General Manager of the Bank when it had single general manager for the whole bank.

After nationalization, Nilgiris became the one of best banked centres with the presence of almost all the banks including private banks. Nilgiris has the distinction of having more than 100% CD ratio for many years.

Today Nilgiris is an overbanked centre with too many loans chasing too few credible borrowers.

Nilgiri Documentation Centre